The Benefits of Extras Cover in Health Insurance

Introduction: Understanding the Importance of Comprehensive Coverage

When it comes to health insurance, many people focus solely on hospital cover, which is essential for managing medical emergencies and surgeries. However, there’s another crucial component that can significantly enhance your overall healthcare experience—extras cover. This type of coverage offers a wide range of benefits beyond traditional hospital insurance, providing peace of mind and financial protection for everyday health needs. In this article, we’ll delve into the advantages of adding extras cover to your health insurance policy, exploring how it can improve your quality of life while saving you money in the long run.

What Exactly Is Extras Cover?

Extras cover, also known as ancillary or general treatment cover, complements your hospital insurance by covering services not typically included in standard policies. These services often include dental care, optical treatments, physiotherapy, chiropractic care, occupational therapy, podiatry, and more. Unlike hospital cover, which focuses on inpatient care, extras cover addresses outpatient services, ensuring you have access to comprehensive healthcare without breaking the bank.

Key Features of Extras Cover:

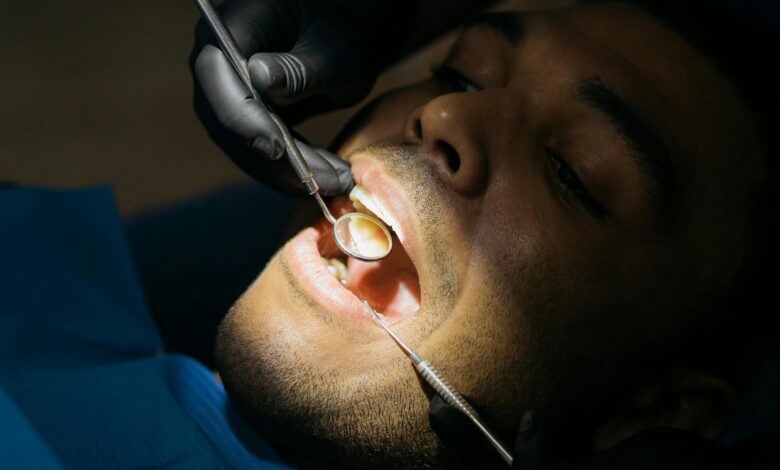

- Dental Services: Routine check-ups, cleanings, fillings, root canals, orthodontics (in some plans).

- Optical Care: Eye exams, prescription glasses, and contact lenses.

- Alternative Therapies: Acupuncture, naturopathy, osteopathy, and other holistic treatments.

- Wellness Programs: Gym memberships, weight management programs, and nutritional counseling.

- Rehabilitation Services: Physiotherapy, hydrotherapy, and speech therapy.

By including these services under one umbrella, extras cover ensures that you receive well-rounded support for both preventive and ongoing health needs.

Why Should You Consider Extras Cover?

While basic hospital insurance provides critical protection during emergencies, it doesn’t address the myriad day-to-day health concerns that arise over time. Here’s why incorporating extras cover into your health insurance plan makes sense:

1. Cost Savings on Out-of-Pocket Expenses

Without extras cover, paying for routine dental visits, new eyeglasses, or regular physiotherapy sessions out of pocket can quickly add up. With extras cover, you enjoy reduced costs—or even full reimbursement—for these services, depending on your policy limits. This financial cushion allows you to prioritize your health without worrying about unexpected bills.

Example Scenario:

Imagine needing a series of physiotherapy sessions after an injury. Without extras cover, each session might cost $80-$120. If your policy reimburses 80% of those expenses, you’d save hundreds of dollars over just a few months.

2. Preventive Care Reduces Future Costs

One of the most significant benefits of extras cover is its emphasis on preventive care. Regular dental cleanings, eye exams, and wellness consultations help catch potential issues early, preventing them from escalating into costly problems down the line. For instance, addressing cavities promptly through routine dental check-ups can prevent the need for expensive root canals or extractions later.

3. Enhanced Quality of Life

Health isn’t just about treating illnesses; it’s about maintaining overall well-being. Extras cover empowers you to take proactive steps toward better physical and mental health. Whether it’s attending yoga classes, receiving acupuncture for stress relief, or improving posture with chiropractic adjustments, these services contribute to a healthier, happier lifestyle.

Mental Health Support:

Many modern extras policies now include coverage for psychological counseling and mindfulness programs. Given the growing awareness of mental health challenges, having access to affordable therapy options can be invaluable.

4. Customizable Plans to Suit Your Needs

Not all extras covers are created equal. Most insurers offer tiered plans ranging from basic to premium, allowing you to tailor your coverage based on your specific requirements and budget. If you prioritize dental care but rarely visit the optometrist, you can choose a plan that allocates higher benefits for dental services. This flexibility ensures you only pay for what you truly need.

Tips for Choosing the Right Plan:

- Assess your current health habits and future expectations.

- Compare benefit limits, waiting periods, and exclusions across different providers.

- Opt for a plan that aligns with your lifestyle and financial goals.

5. Avoiding Lifetime Health Cover Loading Penalties

In countries like Australia, individuals who delay purchasing private health insurance may face lifetime health cover loading penalties. Adding extras cover to your policy can sometimes qualify as part of your overall health insurance commitment, helping you avoid such penalties while maximizing your benefits.

Common Misconceptions About Extras Cover

Despite its numerous advantages, some people hesitate to invest in extras cover due to misconceptions. Let’s address a few common ones:

Myth #1: “It’s Too Expensive”

Reality: While premiums vary depending on the level of coverage, extras cover is generally affordable compared to hospital insurance. Many insurers offer family discounts, no-claim bonuses, and flexible payment options, making it accessible for almost everyone.

Myth #2: “I Don’t Need It if I’m Healthy”

Reality: Even healthy individuals benefit from extras cover. Preventive care keeps minor issues from becoming major ones, and unexpected injuries or conditions can occur at any time. Plus, taking advantage of wellness perks like gym subsidies can further boost your vitality.

Myth #3: “The Waiting Periods Are Too Long”

Reality: While certain services may require short waiting periods before claims can be made, many providers waive these for pre-existing conditions or offer expedited approvals for urgent cases. Additionally, once the initial waiting period ends, you can begin enjoying your benefits immediately.

Maximizing Your Extras Cover Benefits

To get the most out of your extras cover, consider the following strategies:

- Read Your Policy Carefully : Understand what’s covered, the annual limits, and any restrictions or exclusions.

- Schedule Regular Appointments : Take advantage of routine check-ups and screenings to stay ahead of potential health issues.

- Utilize Wellness Perks : Explore gym rebates, nutrition workshops, or meditation classes offered through your insurer.

- Track Your Usage : Keep records of your claims and usage to ensure you’re fully utilizing your allocated benefits each year.

- Review Annually : Reassess your needs annually and adjust your plan as necessary to reflect changes in your health or lifestyle.